Impact

As Impact Investors driving positive environmental and social change in New Zealand, it is important that we track and report on the impact of our investments.

Philosophy and Approach

Vision

To demonstrate how investment can protect and regenerate the environment, support the low/no carbon transition and provide opportunities for people to flourish as part of the new economy.

Mission

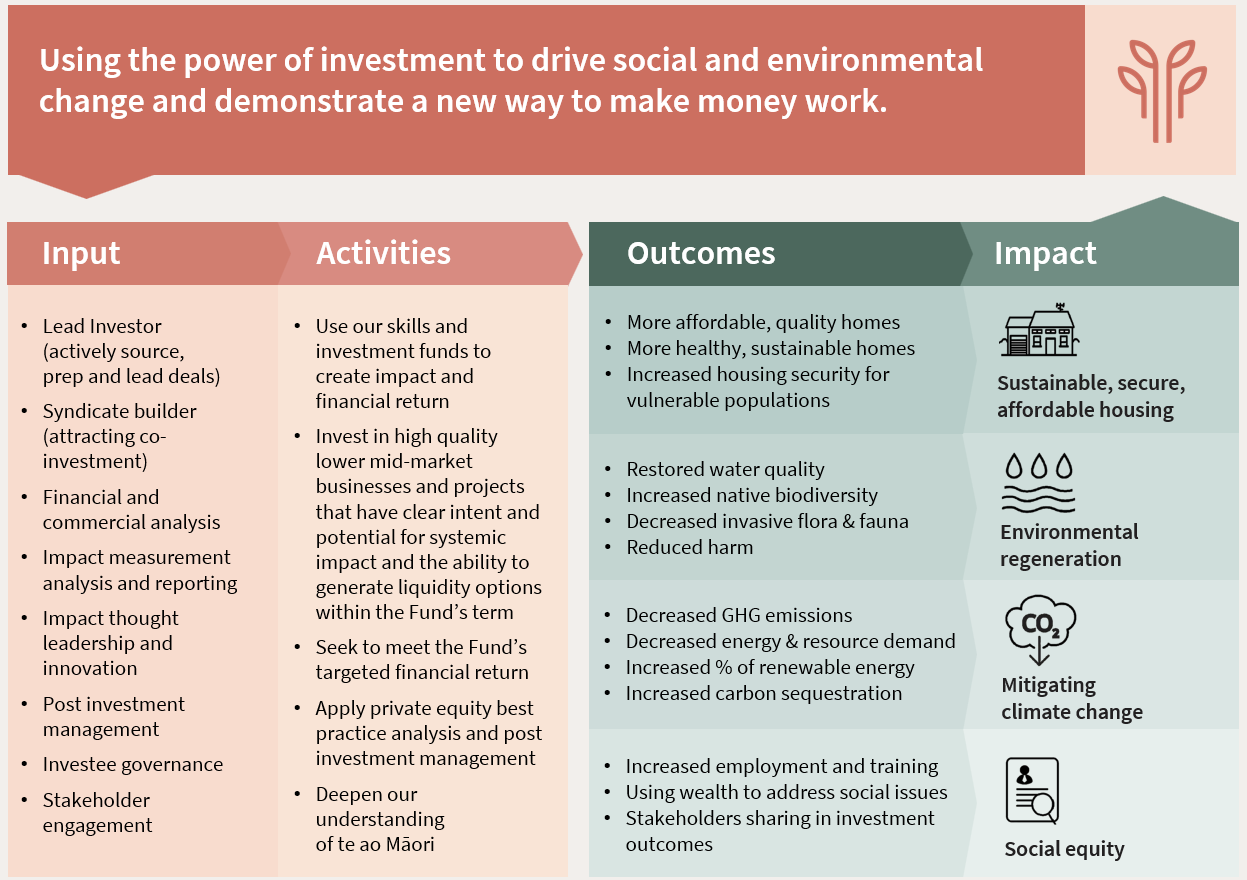

Use the power of investment to drive social and environmental change and demonstrate a new way to make money work.

Strategy

We invest in projects and companies that have clear systemic impact potential and intent, ability to meet the Fund’s financial return target and can generate liquidity options within the Fund’s term.

Our Theory of Change

Assumptions

-

- We recognise that Impact Investing is just one of many actions needed to drive social and environmental change in New Zealand, but we believe that strategic impact investment can play a key role.

- We aim to use knowledge, networks, investment, skills and leadership, working in partnership with others, including the commercial and philanthropic investment sectors and Māori to achieve our Vision.

- The intention is to provide confidence to the investment market so that investment funds flow into impact investments via our Funds, co-investment, syndicated investment and blended finance.

- This will be done intentionally, within the bounds of our Fund’s mandates and with rigorous due diligence in the measurement of both financial and non-financial (impact) risk and return.

- We will refine and improve our approach to impact investment and measurement over time.

Principles, Frameworks and Standards

We strive to use best reporting practices, including the below complementary approaches:

Principles

The Operating Principles for Impact Management (Impact Principles) is hosted by the Global Impact Investing Network (GIIN), the leading global industry body for Impact Investing. Purpose Capital became a signatory in June 2023. Our first disclosure report is available here, and the independent verification report, prepared by The Lever Room, is available here.

Frameworks

The Impact Management Project (IMP) builds global consensus on how to measure, manage and report impact. We have used the IMP Five Dimensions of Impact Framework since the Purpose Capital Impact Fund’s inception. The dimensions help explain the intended impact as well as progress towards reaching the impact targets.

Standards

IRIS+ metrics are standardized indicators that describe an organization’s social, environmental, and financial performance. The GIIN offers IRIS+ as a free and public good to advance impact investing around the world. Purpose Capital aligns our metrics with IRIS+ indicators as much as possible while taking a pragmatic approach to using other, more context appropriate metrics when needed.

Our Impact Investments

Whakatōhea Mussels Ōpōtiki Limited

A New Zealand first and world leading open ocean mussel farm and mussel processing plant.

Bureta Park Build to Rent

Affordable housing stock in Tauranga for both renters and first homebuyers alike.

Homes for Tamariki

Assisting in housing the most vulnerable children and young adults in the care of Oranga Tamariki.

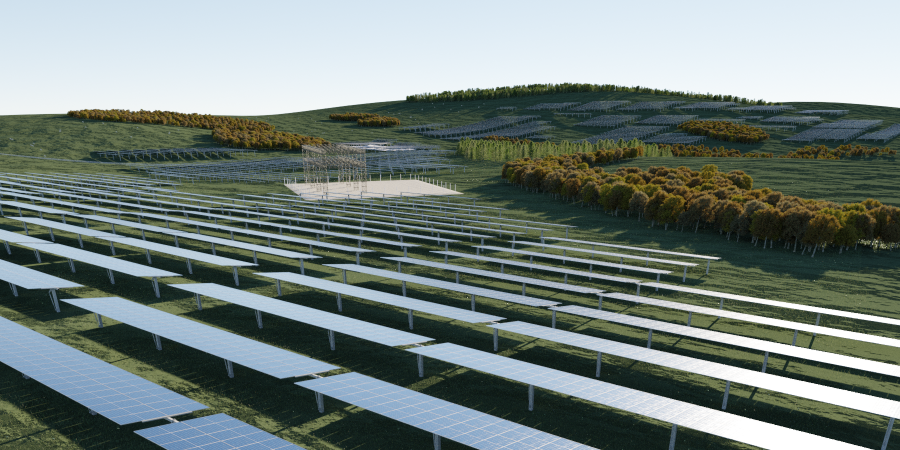

Lodestone Energy

Pioneering Utility-Scale Solar Agri-voltaics in the Bay of Plenty, Waikato, and North Island.

Cool Group

Providing next-generation refrigeration technology and low GWP refrigerant.

Maungaturoto Solar Farm

Providing equity funding to build a 21MW solar farm project in Northland.

Impact Reports

These reports contains outcome measurements and impact updates for our portfolio companies.

We are committed to continuously refining our activities to meet best practices in the nascent, yet rapidly maturing, field of impact investing, and look forward to reporting again in mid 2025!

White Papers

Thought Leadership

Walking the Talk: Purpose Capital’s Carbon Reduction Journey

At Purpose Capital, we believe it is important to “walk the talk” in our own operations. After completing our third year of measuring and offsetting 120% of our emissions, we’re sharing our reflections in the hopes of encouraging those who are just getting started on...

The Degrowth Opportunity

In late 2021, Purpose Capital, Executive Director, Bill Murphy collaborated with Jennifer Wilkins to publish a tentative white paper, Investing In Degrowth. This paper received a great response and showed there is genuine interest in degrowth within the business...

Air Pollution: A Far Deadlier Killer Than COVID-19?

Fossil fuels pollute the earth – So what? It’s normal... Right? Most of us understand that fossil fuels have a dramatic negative impact on the environment and are accelerators of climate change. However, many of us fail to comprehend the urgency and enormity of the...

Investing in Degrowth

Many of us now accept that humanity is operating in a way that is causing climate change, increasing inequality and a more precarious future for our children. That way of operating is called growth, endless growth. But what’s the alternative? How can you invest in...

Calling for Investable Climate Solutions!

You are implementing an important environmental or climate related solution. You are ready to expand and scale it to make a real difference as part of your existing or new business/project. But you need investment and additional smarts. You want investors that share...

Growth and Doughnuts

Things are ‘out of whack’ seems a fair summary of our state of affairs. Climate change, economic inequality, mass migration, conflict and human unhappiness. If our economic and political systems are supposed to prevent or address these things, clearly, they aren’t. Of...

ESG and Beyond

At this point I’m sure most of us have heard about ESG. Here’s one definition:ESG stands for Environmental, Social, and Governance. Investors are increasingly applying these non-financial factors as part of their analysis process to identify material risks and growth...

Reimagining Investment

“Anyone who believes that exponential growth can go on forever in a finite world is either a madman or an economist.” Kenneth Boulding, 1973 Or maybe an investor. Why do we invest money? A simple question with an apparently simple answer – so the money makes us more...

Summary of the Climate Change Commission’s Draft Advice for Consultation report

In case you haven’t heard of the Climate Change Commission or had time to read the 180 page 2021 Draft Advice for Consultation report, we have put together this brief on some of the main points. What is the Commission? The Climate Change Commission is an independent...

News

Purpose Capital Consortium increases investment in Lodestone Energy to $21m

In March 2025, a Purpose Capital led syndicate increased its total investment in Lodestone Energy to $21 milion. The Purpose Capital impact syndicate consists of Purpose Capital Impact Fund, Tauhara North No2 Trust, Trust Horizon, individuals and family trusts, as...

Independent Verification of Purpose Capital’s Impact Principles Alignment: A First for New Zealand

We are pleased to share that The Lever Room has independently verified Purpose Capital’s alignment with the Operating Principles of Impact Management (Impact Principles). The Impact Principles provide a best practice framework for integrating impact considerations...

Purpose Capital invests in Maungaturoto Solar Farm

Purpose Capital has partnered with Harbour Infrastructure and Tupu Tonu (Ngāpuhi Investment Fund), to provide equity funding for a 21MW solar farm project in Maungaturoto, Northland. The site is expected to generate around 32GWh of electricity per annum, which is...

RIAA Recognises Purpose Capital as an Responsible Investment Leader

Purpose Capital has been recognized as a Responsible Investment Leader by the Responsible Investment Association Australasia (RIAA) for the second year running. We placed in the top 20% of organisations assessed, demonstrating leading practice in our commitment to...

Response to the Second Emissions Reduction Plan

As Impact Investment Fund Managers, it’s important that Purpose Capital comments on the New Zealand Government’s Second Emissions Reduction Plan (ERP2), especially as related to scaling private investment in emissions reduction. Our key recommendations are that the...

Impact Principles Disclosure Statement

The Operating Principles for Impact Management (Impact Principles) is hosted by the Global Impact Investing Network (GIIN), the leading industry body for Impact Investing globally. The Impact Principles help investors ensure that impact is integrated throughout the...

Purpose Capital Consortium increases investment in Lodestone Energy to $17.4M

In March 2024 Purpose Capital led a $7.4M syndicated follow-on investment into Lodestone Energy The Purpose Capital impact syndicate consisted of Purpose Capital Impact Fund, Tauhara North No2 Trust, Trust Horizon, as well as investors from the Purpose Capital Impact...

Kaitāia Live – Lodestone Powers On NZ’s Largest Solar Farm

We are pleased to share that Lodestone Energy is generating power at its Kaitāia solar farm – marking a major milestone for utility-scale solar in New Zealand. Purpose Capital led a $10M syndicated investment into Lodestone Energy’s series B raise last year. Their...

Purpose Capital invests in Innovative Refrigeration manufacturer, Cool Group

Largest investment to date Purpose Capital Impact Fund has made a $3m investment into Cool Group Ltd. Cool Group is a New Zealand-owned and operated company whose subsidiaries include: CoolSense NZ Ltd, Original Equipment Manufacturer (OEM) of commercial and...

Purpose Capital Wins 2023 Best Impact Investment Fund Award

Purpose Capital is the proud recipient of the 2023 Best Impact Investment Fund award – our second year in a row winning this award. The Mindful Money Awards celebrate the role that ethical and impact investing are playing in making money a force for good. They reflect...

Purpose Capital Consortium invests $10M in Lodestone Energy

Lodestone Energy is pioneering, at a significant scale, utility-scale solar agri-voltaics in New Zealand. Upon completion, Lodestone’s solar electricity generated across its five farms will increase solar generation in New Zealand by 8 times the 2021 levels. Once it...

Purpose Capital Wins Best Impact Investment Fund Award

At the recent annual Mindful Money Awards in Auckland, the Purpose Capital Impact Fund won the 2022 Best Impact Investment Fund award. The Mindful Money Awards celebrate the role that ethical and impact investing are playing in making money a force for good. They...

EECA GIDI Private Finance Pilot | Purpose Capital

EECA (the Energy Efficiency and Conservation Authority) has commenced a private finance pilot with participating financial providers to help unlock the finance required for valuable decarbonisation projects to move forward. Purpose Capital has been selected to...

Impact Investment Fund Tackles the Housing Crisis

Tauranga is set to receive a much-needed increase in supply of affordable, healthy, and well-located homes that put social and environmental needs at the forefront thanks to impact investment fund, Purpose Capital, it’s partners, and specialist build-to-rent company...

NZ’s Largest Impact Investment Fund Makes Its Mark

An estimated 230 new jobs will be created in the Eastern Bay of Plenty and future employees’ social and educational needs will be a top priority thanks to New Zealand’s largest impact investment fund. The Purpose Capital Impact Fund (PCIF) has announced its...

NZ’s Largest Impact Investing Fund Raises $20M

Corporate foundation heavyweights and high net-worth individuals are combining forces with the philanthropic sector and family trusts to invest in innovative solutions to New Zealand’s social and environment problems. It is the first time the commercial sector has...

Invest To Make A Difference – Public Launch Purpose Capital Impact Fund

Earlier this week the Purpose Capital Impact Fund was launched at an event in Tauranga. The keynote speaker was Robbie Tindall who spoke about his work with K1W1, which has invested $250m in NZ technology and innovation companies, and his experience as a Trustee of...

Major Investors

Our sincere gratitude to the following Major Investors.