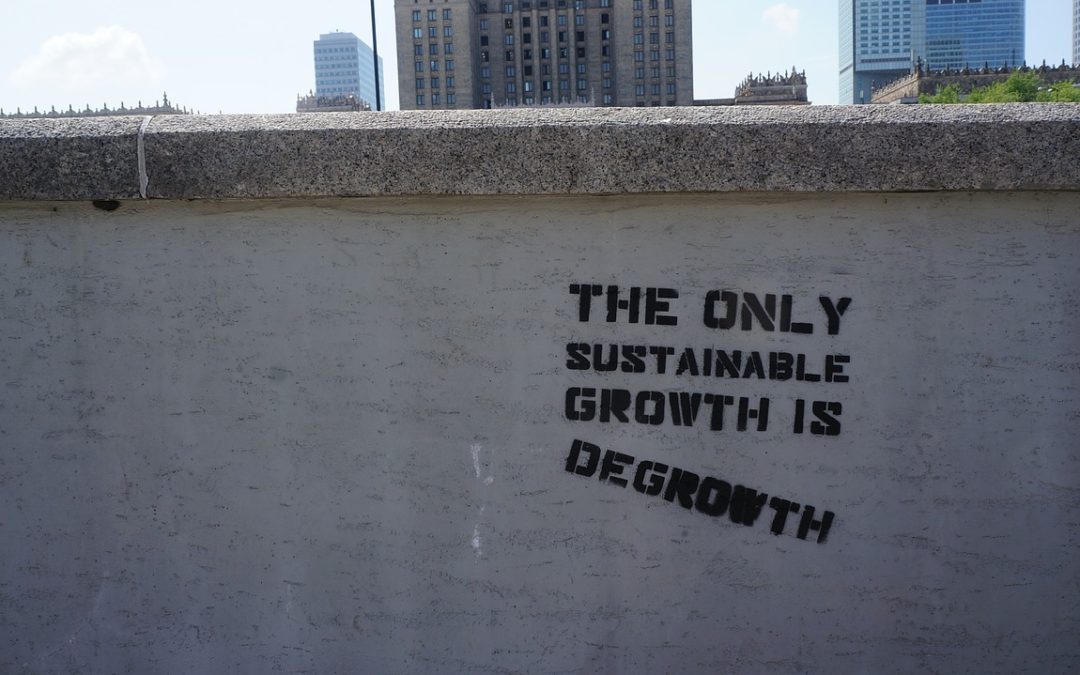

Many of us now accept that humanity is operating in a way that is causing climate change, increasing inequality and a more precarious future for our children. That way of operating is called growth, endless growth. But what’s the alternative? How can you invest in things that shrink rather than grow?

Investing in Degrowth is a first-of-its-kind white paper drawing attention to the emerging degrowth economy, setting out the rationale for investing in degrowth-compatible enterprises and laying down the groundwork for deciding the core characteristics of degrowth investing. I have published this in collaboration with Jennifer Wilkins as a call for New Zealand’s sustainable investing and finance communities to consider the feasibility of funding the transition to a new economy that no longer supports economic activities that fall outside safe ecological and fair social boundaries.

David Woods, a leader in impact investing and sustainable finance in New Zealand, writes in the foreword: “We’re on an exciting journey as capitalism rediscovers itself, and it goes far beyond just greening the economy. Degrowth (including, for instance, circularity) is a significant part of this journey, and this thought-provoking white paper is a welcome addition to the canon of ideas for our country and our world.”

Purpose Capital is an impact investment fund whose mission is to drive social and environmental change.

We believe the next steps to build upon the ideas presented in this whitepaper are to expand the dialogue within the sustainable investing community and to show how these ideas are even now being brought to life through degrowth-compatible companies and initiatives.

Your feedback and responses to this white paper can contribute to that discourse and we encourage you to get in touch.

If you have an investable opportunity that will create systemic change and deliver intentional social and/or environmental impact click the button below to get in touch.

Alternatively register your interest to invest in our next Fund.